SUCCESS

The Debate around Crypto Mixers: Privacy Innovation or Money-Laundering Risk?

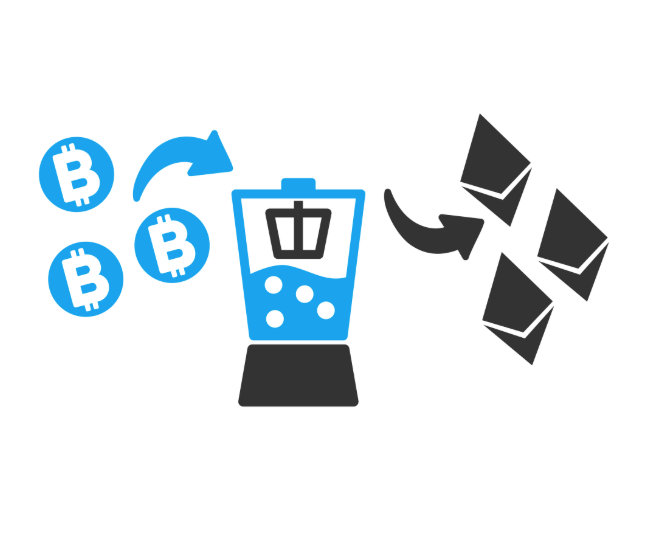

In the ever-changing landscape of cryptocurrency, few tools have been as controversial as crypto mixers. Also known as tumblers, these services allow users to mix in and redistribute their digital assets, making tracking and tracing of digital assets much more difficult.

For some, crypto mixers are a game-changer in ensuring financial privacy. For others, they are synonymous with money laundering, sanctions evasion, and illicit finance. As always, the truth is somewhere in the middle.

Privacy in the Digital Age

The case for mixers begins with privacy. Each Bitcoin or Ethereum transaction is immutably recorded on a public blockchain, which means that anyone with the right tools could trace users’ activity. Unlike with conventional banking, which guarantees at least some level of confidentiality, cryptocurrency by design is radically transparent.

Mixers grew out of a reaction to this transparency. They allow normal people to encrypt their personal financial activity and protect it from spy agencies, governments, and criminals. For privacy advocates, they are not criminal tools but digital rights of defense in an age of mass data collection.

The Dark Side of Anonymity

Yet some of the same features that make mixers an attractive option for privacy-minded people also make them an attractive option for criminals. Regulators caution that mixers may enable ransomware pay-outs, darknet transactions, and the transfer of stolen funds. High-profile enforcement actions against platforms such as Tornado Cash highlight these issues, with the authorities arguing that they have become a place where billions of dollars can be laundered.

The tension between innovation and compliance is shown by the recent legal scrutiny around the developers of such platforms. As Summarized in this detailed report on the Tornado Cash trial, the result could set a precedent for how open-source developers in the crypto industry are handled by regulators.

A Regulatory Crossroads

The debate concerning mixers is actually a debate concerning the boundaries of monetary independence. Do people have the right to transact privately, even if that right can be used for criminal purposes? Or should regulators focus on security and stability, even when doing so at the expense of privacy?

The latter is increasingly the approach of choice for governments. In the United States and Europe, sanctions have been imposed, stronger KYC (Know Your Customer) regulations have been enforced, and exchanges have been compelled to block funds associated with mixers. Critics say these measures run the risk of creating chokepoints and criminalizing code instead of the bad actors themselves.

Conclusion

The problem today is to find the balance. While privacy-ensuring technologies will not go away, more will be required, and user adoption will increase as digital surveillance inevitably intensifies. But unregulated anonymity could also have a detrimental effect on the credibility and adoption of cryptocurrencies in mainstream finance.

What we can expect next is a new generation of privacy-preserving technologies that can satisfy both regulators and users—solutions that ensure confidentiality but preserve compliance. Whether such a middle ground is feasible remains an open question, but the discourse around crypto mixers ensures that the conversation about privacy, innovation, and risk in the digital finance space is far from over.