ENTREPRENEURSHIP

A Quick Guide on the Benefits of SMSF Services

A Self-Managed Super Fund (SMSF) is an unemployment insurance trust scheme that benefits its shareholders upon retirement. The main differentiator between SMSFs and other super funds is that the fund’s trustees are also SMSF members.

SMSF could be considered as more like a self-assurance; the primary goal is to ensure a pension upon retirement or death insurance to its members. The SMSF has and must have a bank account with its Australian Company Number and Tax File Number. As you would with a retail super fund, the fund members simply direct their superannuation contributions into the SMSF bank account.

What Can You Do with An SMSF?

To help finance the payment, you can also take loans from your retailed investment funds. There are several strict guidelines for borrowing, so before you consider doing this, you will need to check the SMSF. To think wisely, paying yourself a pension is a brilliant way to finance your retirement. You can set up your retirement, so it is just like you have been used to having your usual weekly or fortnightly wage for the past 40-50 years with SMSF.

Also, smsf services offer much more benefits to you. If you are ready to take the holiday of a lifetime or buy a new car, a lump could be withdrawn from your SMSF. When you want to take these lump sums from your SMSF, you have the right to decide. It is a matter most people hate to speak about, but for your family, it is an important matter.

Does SMSF Need to Be Audited Every Year?

SMSF audits are compulsory in Australia and must be carried out by an auditor registered with the Australian Securities and Investments Commission (ASIC). This auditor must be autonomous. It is the responsibility of an SMSF auditor to assess its financial statements and assesses its compliance with the superannuation law.

What Are the SMSFs Pros and Cons?

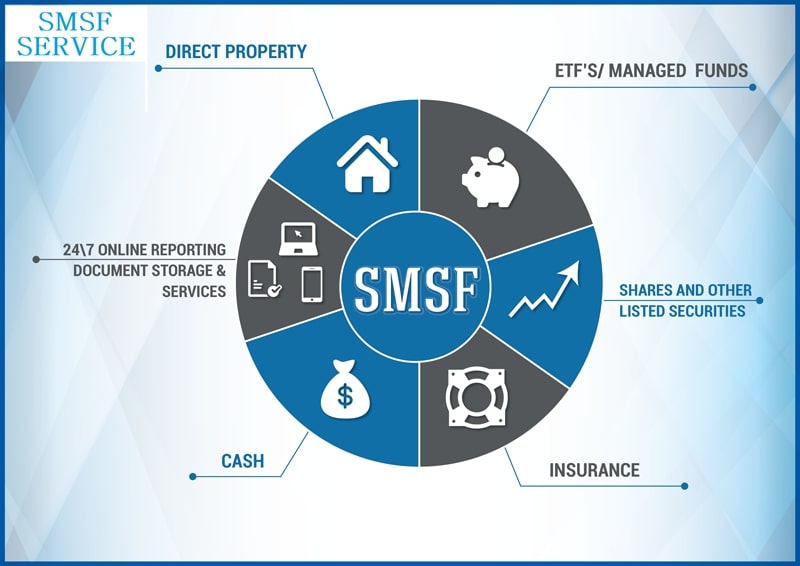

What is best about it is that smsf services offer a broader range of investment options than other superannuation funds, and there are several benefits of an SMSF you can enjoy. An SMSF can invest in virtually anything with some small exceptions; Guarantee also meets the sole objective test and complies with its regulations. Investment in direct property requires this.

There is the flexibility to alter the SMSF rules to fit their specific needs and conditions, as the fund members are also the trustees. It is not available for most superannuation funds. Following market shifts or going to take up unexpected investment opportunities, direct managing your super investments helps you make swift adjustments to your portfolio. Tax rates on SMSFs are the same as other SMSFs, so it is easier to put tax strategies into SMSF that better support you and your situation.

If you want to see a sample template for your proof of income, checkstubs that look totally real and formal, find out more about the page right here.

Takeaway

SMSFs are a good idea if you have done your research and understand risk. Before these new platforms, the minimum balance expected is probably at least twice the amount of it. Remember, if you are planning significant contributions in the next few years, the current ratio is not that important. Managing and building up an SMSF requires many costs to be more convenient than the standard super fund. It is a helpful reference to take into consideration.